north carolina sales tax rate on food

The Asheville sales tax rate is. The sales tax rate on food is 2.

Lease or Rental of Tangible Personal Property.

. PO Box 25000 Raleigh NC 27640. General Sales and Use Tax. The County sales tax rate is.

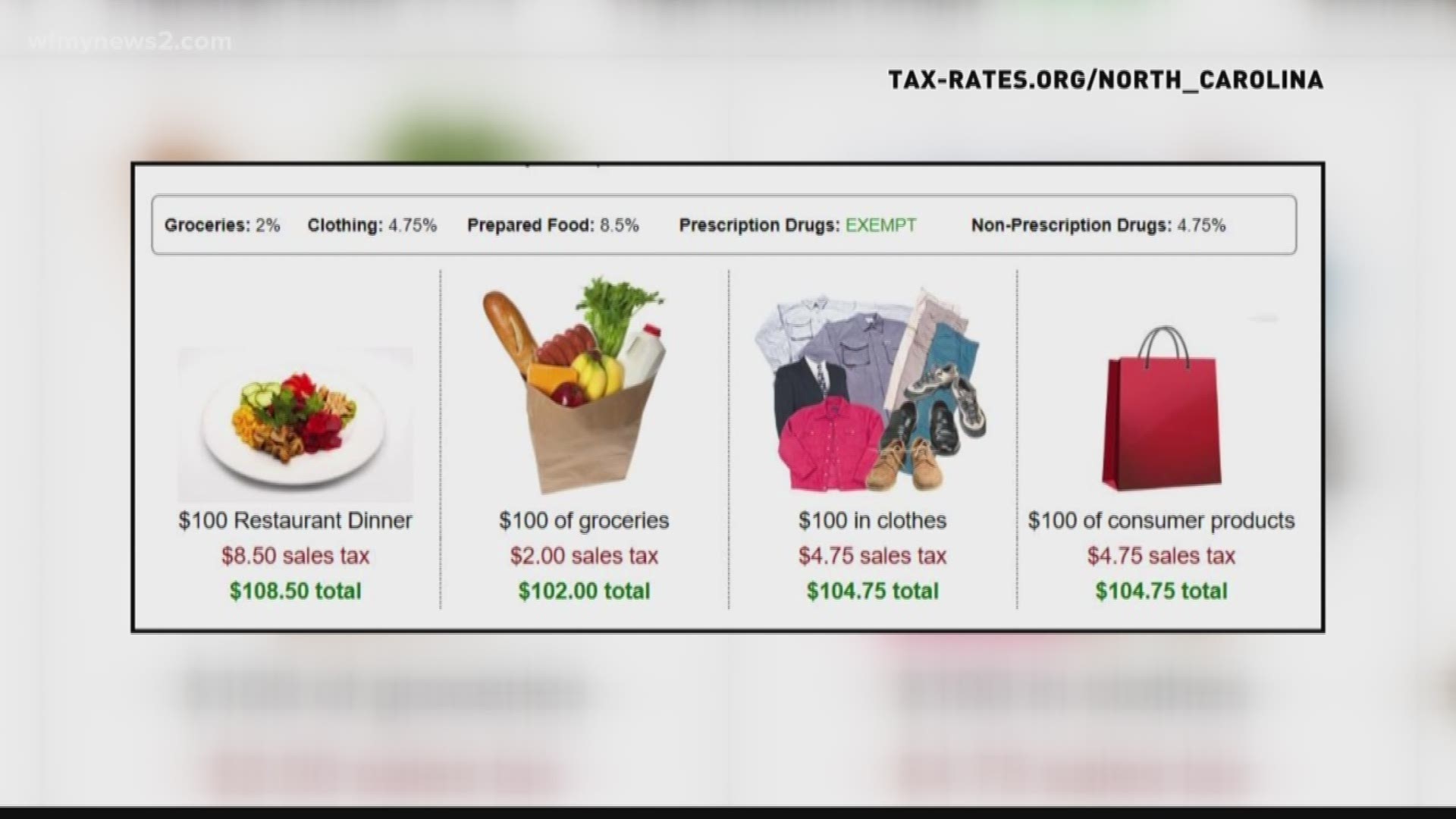

Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants. According to North Carolina law youd be required to charge. This page describes the taxability of food and meals in North Carolina including catering and grocery food.

This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that serve food. Food Tax The 2 Food Tax is charged on retail sales and purchases of. The transit and other local rates do not apply to qualifying food.

31 rows The state sales tax rate in North Carolina is 4750. How much is sales tax in North Carolina. The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants.

The North Carolina state sales tax rate and use tax rate is 475. North Carolina Department of Revenue. Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

Nc State Sales Tax On Food. The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General Assembly. A customer buys a toothbrush a bag of candy and a loaf of bread.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222 on top of the state tax. The provision is found in GS.

One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina. Idaho Legislature 2017 regular legislative. The sales tax rate on food is 2.

Those who sell unprocessed agricultural products they actually produce are not required to collect sales tax from their customers. Sales taxes are not charged on services or labor. With local taxes the total sales tax rate is between 6750 and 7500.

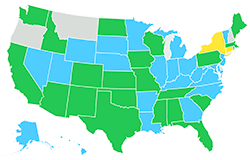

Exceptions include localities in Arizona Colorado Georgia Louisiana North Carolina and South Carolina where grocery food purchases are fully or partially exempt at the state level but typically taxed at the local level. Food sales subject to local taxes. In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

Select the North Carolina city from the list of. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. Sales taxes are not charged on services or labor.

53 rows Table 1. WFMY in North Carolina reports that half of a random sampling of stores 5 out of 10 charged too much sales tax on Kit Kats. Most households in the state pay the full sales tax rate on food.

This is the total of state county and city sales tax rates. This means that depending on your location within North Carolina the total tax you pay can be significantly higher than the 475 state sales tax. Overview of Sales and Use Taxes.

Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. Three stores Krishna Food Mart Kims Grocery and Jays Grocery charged 7 cents. You own a grocery store in Murphy NC.

Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. North Carolina has recent rate changes Fri Jan 01 2021. We include these in their state sales.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Sheetz and Summit Shell Xpress Mart charged 8 cents. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. California 1 Utah 125 and Virginia 1. The minimum combined 2022 sales tax rate for Asheville North Carolina is.

To learn more see a full list of taxable and tax-exempt items in North Carolina. Average Sales Tax With Local. Candy however is generally taxed at the full combined sales tax rate.

Apparel and Linen Rental Businesses and Other Similar Businesses. They all should have charged 2 cents. The North Carolina use tax rate is 475 the same as the regular North Carolina sales tax.

The North Carolina sales tax rate is currently. Statutes regarding the collection of sales taxes by some vendors who sell products at farmers markets and other events. Manufactured and Modular Homes.

No matter if you are based in North Carolina or not based there but have sales tax nexus there charge sales tax at the rate of your buyers ship to location. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Including local taxes the North Carolina use tax can be as high as 2750.

Arkansas 3 percent illinois 1 percent missouri 1225 percent tennessee 6 percent utah 275 percent west. The base state sales tax rate in North Carolina is 475. The 2013 legislation also imposes new requirements on those who manage farmers markets.

Taxation of food and prepared food The minimum combined 2021 sales tax rate for asheville north carolina is. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Retail Sales Retail sales of tangible personal property are subject to.

Food Non-Qualifying Food and Prepaid Meal Plans. Counties and cities in North Carolina are allowed to charge an additional local sales tax on top of the North Carolina state sales tax. NORTH CAROLINA 475 4 NORTH DAKOTA 5 OHIO 575 OKLAHOMA 45 OREGON none -- -- --PENNSYLVANIA 6 RHODE ISLAND 7.

105-1643 and reads as follows. North Carolina has recent rate changes Fri Jan 01 2021. Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina.

B Three states levy mandatory statewide local add-on sales taxes. Food that meets at least one of the conditions of this subdivision. STATE SALES TAX RATES AND FOOD DRUG EXEMPTIONS As of January 1 2022 5 Includes a statewide 125 tax levied by local governments in Utah.

92 out of the 100 counties in North Carolina collect a local surtax of 2.

The 5 Best Assisted Living Facilities In Southern Pines Nc For 2022

Tax Friendly States For Retirees Best Places To Pay The Least

Is Food Taxable In North Carolina Taxjar

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Tax Friendly States For Retirees Best Places To Pay The Least

Everything You Need To Know About Restaurant Taxes

Corporate Tax Rates By State Where To Start A Business

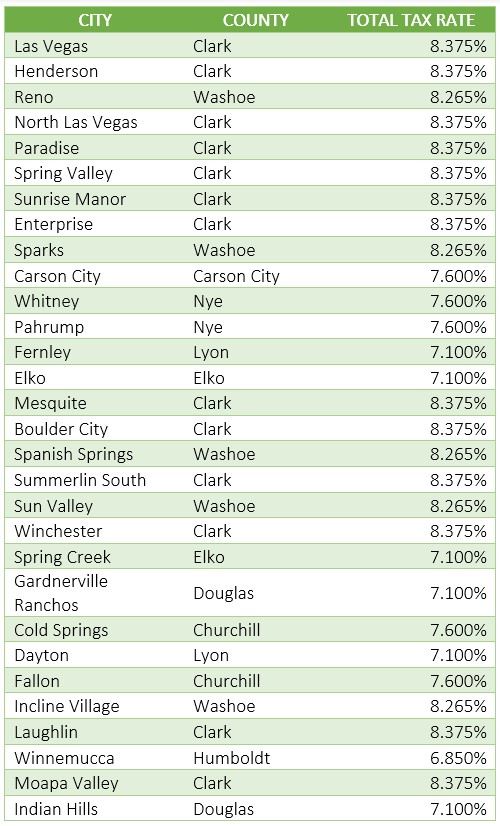

Nevada Sales Tax Guide For Businesses

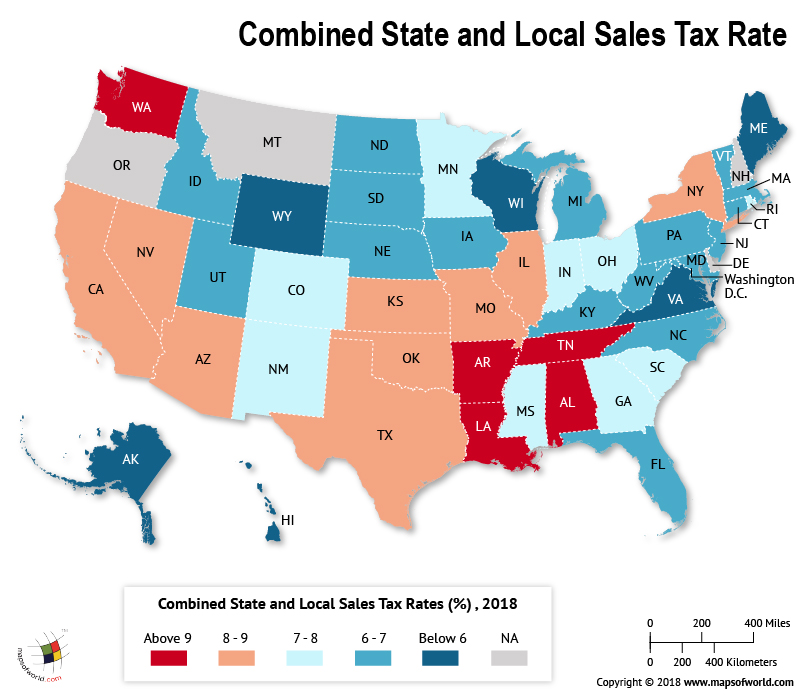

States With Highest And Lowest Sales Tax Rates

North Carolina Sales Tax Small Business Guide Truic

States Without Sales Tax Article

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers